09 January 2023

What’s Trending?

Can fintech become India's growth engine?

It is common knowledge that fintech is transforming the financial industry on a scale never seen before. In what manner can it steer India's economic growth? Let’s explore!

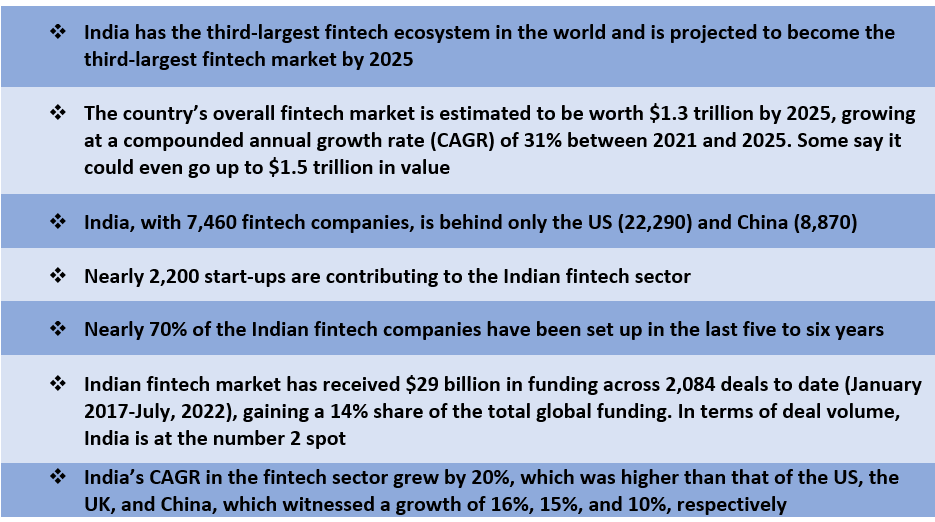

Here are the mind-blowing statistics and the perfectly poised fintech ecosystem that are any indication.

Problems Fintech Can Solve!

Fintech has the potential to single-handedly solve many of the credit ills plaguing the Micro, Small and Medium Enterprises (MSMEs) which, with a whopping 30% contribution to the GDP, forms the backbone of the Indian economy. MSMEs is the second-largest employment sector in India after the agricultural sector. Both fintech and MSMEs are looking at each other with high expectations. While MSMEs are struggling with the problems of access to cheap finance and cashflow management, the fintech companies see immense potential in the sector. Fintech adoption rate in the MSMEs space is quite slow and if this hurdle is removed, it can be a win-win situation for both, and ultimately powering India’s growth.

Overall, fintech is spurring investments and bringing in efficiency and energy in the financial and corporate sectors, reducing costs and improving quality of financial services thereby pushing the penetration of banking and financial services in new areas. If all goes well, India is well on its way to achieving the goal of becoming a

$ 5 trillion economy.

What is driving the growth of fintech in India?

ROBUST FINANCIAL & TECH RESOURCES

A combination of factors has made India’s fintech market an attractive proposition for all stakeholders. India has a robust start-up ecosystem, cutting-edge technology backed by the mature IT industry, a deep reservoir of engineering, financial and entrepreneurial talent, constantly growing public digital infrastructure (better known as India Stack), fast-increasing Internet and smartphone penetrations and, above all, an aspirational customer base. In the past, demonetisation and the government’s strong push for digitisation and financial inclusion programmes such as Pradhan Mantri Jan Dhan Yojana and Direct Benefit Transfer contributed to the fintech growth.

RISE IN E-COMMERCE CONSUMPTION

The burgeoning e-commerce sector is another big driver of the Indian fintech industry. The Indian e-commerce industry is set to touch $ 111.40 billion by 2025 and surpass the US to become the second-largest e-commerce market in the world by 2034.

STEPS TAKEN BY THE GOVERNMENT

Government-backed path-breaking digital services such as Aadhaar, undoubtedly the world’s biggest identity database, Unified Payments Interface (UPI), an instant real-time payment system, e-KYC, eSign, Bharat Bill Payment System and DigiLocker and the recent Co-WIN application, which spearheaded the mammoth Covid-19 vaccination drive in India, have contributed to the exponential growth of the fintech space in the past several years. The nurturing initiatives of the regulatory bodies gave the nascent sector the necessary push.

MAJORITY YOUNG AND EARNING POPULATION

The sector is gaining from massive demographic opportunities. India largely being the country of the young, and there is a strong appetite for hassle-free, quick, smart, innovative and personalised banking services and products. This is reflected in the companies’ enthusiasm to constantly innovate to match the millennials’ expectations.

RISE IN SMARTPHONE & INTERNET CONSUMPTION

India currently has 692 million active internet users, and around 346 million Indians are engaged in online transactions, including e-commerce and digital payments. The country has 750 million smartphone users. By 2026, the number of smartphone users in India is projected to touch the 1 billion mark. The smooth penetration of the internet and smartphones is making it easy for fintech companies to reach more and more customers.

CRYPTOCURRENCY ADOPTION

Cryptocurrency market is another sub-segment of fintech that is waiting to skyrocket. Some estimates say that India already has up to 20 million cryptocurrency investors, the highest in the world, with a combined holding of more than $5.37 billion. India is a strong candidate to be a global crypto superpower. What is promising is that it is mostly the young Indians who are powering this growth.

CBDC – THE NEW INDIAN DIGITAL CURRENCY

The exemplary growth of the Indian fintech sector can be partly attributed to the government, regulators and stakeholders being on the same page. Such collaborations result in projects like the recently launched digital currency. In yet another major initiative to promote cashless transactions, the Reserve Bank of India, on November 1, launched India's first digital rupee (e₹) pilot project for the wholesale segment. Also known as Central Bank Digital Currency (CBDC), e₹ is a digital form of currency notes issued by the central bank. The RBI has plans to extend the pilot project to the retail sector soon.

The disruptive trends driving digital payments in India

Fintech’s strength lies in spotting trends and meeting the expectations of its tech-savvy customers. Powered by cutting-edge technologies such as Artificial Intelligence, Blockchain, the Internet of Things (IoT), and the 5G network, fintech keeps innovating and upgrading for better customer experience. Here are some of the latest trends in the payments industry. (Let’s put in some highlighted format, as discussed).

Wearable payment devices

These devices, such as smartwatches, wristbands or smart rings, are directly linked to your bank account or digital wallets and function like a regular debit card. They ensure secure and error-free payments. A couple of banks in India have already introduced these smart payment solutions.

Voice payments

Voice-activated payments, backed by machine learning, artificial intelligence, and neural language processing, has the potential to be a game-changer in the payments industry. You can use the voice technology to send money, order medicine or interact with your favourite grocery store. With so many languages spoken in India, voice-based payments would be both a challenge and opportunity for fintech companies.

Buy Now, Pay Later

The concept of Buy Now, Pay Later, or BNPL, continues to gain ground with fintech making the process seamless. Through BPNL, you can buy a wide-range of products or services, go on a holiday or get treated in a hospital in interest-free instalments. Some super apps also offer you the chance to clear your bills and pay later at 0% interest. BPNL is forging ahead not only in the B2C but also B2B payments space.

Super Apps

A super app, an attractive feature of digital banking, provides a one-point solution to all your banking, financial and investment needs. With a super app, you can borrow from a bank or an NBFC almost instantaneously, send or receive money, check your credit score, pay school fees, trade in cryptocurrency, make credit card payment, order medicine, book a flight ticket, calculate mediclaim, invest and trade in stocks or even chat if you have a complaint.

Digital wallets

As the name suggests, digital wallets are the wallets where you can store and spend funds digitally. You can keep your credit card, debit card, or bank account information in your digital wallet and use your mobile device to make payments for purchases. You can store loyalty points, discount coupons, air tickets, hotel booking details or your identity card – virtually everything that a physical wallet can keep. More and more people are embracing digital wallets for the sheer convenience of it so much so that by 2025 digital wallet use is expected to reach 52.5% of ecommerce transaction value worldwide, up from 48.6% in 2021.

Contactless-enabled credit and debit cards

Such cards allow transactions in a jiffy. You simply tap your card in front of the contactless-enabled payment terminal and pay. You don’t need to key in your PIN to complete the transaction. This frictionless mode of payment is becoming commonplace because it helps you spend less time at cash counters as the number of steps involved in the checkout process are reduced. Moreover, it provides higher payment security.

Biometric authentication

The use of biometrics technologies, which use fingerprint scanning, facial recognition, iris or heartbeat analysis, is fast becoming indispensable for identity authentication in the digital payments’ ecosystem. It provides a high level of safety and security and helps in building customer trust and loyalty. In the age of identity theft and payment frauds, biometric authentication keeps your online transactions safe and secure.

Blockchain technology

Blockchain technology, which has been successfully running the popular cryptocurrency Bitcoin for a long time now, is set to disrupt the digital payments and banking space as well. Blockchain can be used to transfer payments person-to-person around the world without the involvement of intermediaries. It is emerging as an optimal solution for digital payments because it works on a decentralized system, ensures faster settlement and transparency, creates a highly secure underlying software system that can’t be tampered with easily.

Challenges for India's fast-rising fintech sector

Like all other emerging and young businesses, fintech, too, has its own share of challenges. Some of the challenges that the fintech industry faces today relate to data and payment security, regulatory scrutiny and compliance, a lack of awareness among end-users, working alongside legacy systems such as banks, and blockchain integration.

Data security and cybercrimes

Merchant frauds, identity theft, phishing, DDoS (distributed denial-of-service). malware, privacy leak and cyber espionage are some of the data- and security-related challenges that fintech companies need to address on priority. Adequate investments and use of innovative technologies can go a long way in mitigating these risks for consumers.

Lack of financial literacy and awareness

Being a huge and diverse country, India often offers contradictory statistics. For example, in a country with the highest fintech adoption rate, we still have 190 million unbanked people. And all of those with smartphones are not necessarily tech-savvy enough to operate or appreciate fintech apps. The major challenge for the fintech companies is to spread financial literacy.

Regulatory issues

Fintech, a young and dynamic industry needs a mature and pragmatic regulatory mechanism to survive and thrive. The fintech companies and regulators need to be in sync when it comes to regulation to protect the rights of the consumers from data privacy breaches as well as taxation policies that can allow fintech companies enough space to innovate or enhance services.

App retention rate

While the fintech adoption rate in India is the highest in the world, studies show that the app retention rate is less than 20%. A variety of factors are behind users quitting an app without completing intended tasks or not spending enough time on it. Complicated onboarding processes, often accentuated by a lack of human touch, strict procedures, unattractive features and demand for personal financial data such as income are some of the reasons that make a customer abort an app temporarily or for good. Security-related apprehensions and hidden charges also contribute to increased app drop-off rates.

Keeping customers loyal

Banking customers have increasingly become impatient and demanding and more so for neobanks (New-Age banks without any physical location, present entirely online). Gone are the days when customers used to remain loyal to a bank forever. Now, customers will not hesitate to migrate to another banker if they are not satisfied. The tech-savvy customers of fintech apps are voracious consumers looking for ways and means to explore, use and experience financial services and products.

Disclaimer: (Statistics for this write-up have been drawn from various sources, both government and non-government).