The Union Budget 2025 announced last month strives to maintain equilibrium between expansion and financial discipline while accelerating progress across key sectors. As businesses and policymakers adapt to its measures, Dipti Deshpande, Director and Principal Economist, CRISIL Ltd, shares key insights into the evolving landscape and the opportunities that lie ahead.

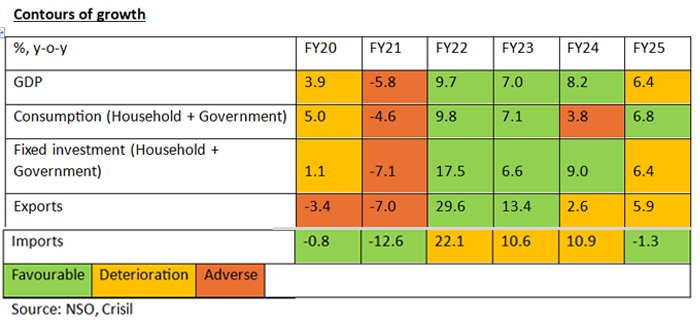

The Indian economy has displayed a fair degree of resilience in the post-pandemic period. After averaging over 8% during fiscals 2021-2024, economic growth is now normalising towards trend. The National Statistical Organisation (NSO) estimates a deceleration in growth to 6.4% this fiscal, from 8.2% last fiscal, mainly due to weak urban consumption amid high inflation and rising interest rates.

A lower fiscal impulse — as the government tapered its spending to allow the economic recovery to take hold — has also weighed on growth. Support has come from a revival in rural consumption, bolstered by healthy agriculture revenues. Overall, private consumption growth recovered to 7.3% this fiscal, from 4% last fiscal, led by the recovery in rural consumption and a low base.

Next fiscal, Crisil expects economic growth to hold up but not see a material lift. As global headwinds intensify, driven by trade shocks, domestic manufacturers are uncertain about input costs and export demand, which could weigh investments.

To navigate such shocks, the economy needs to improve its resilience. In this macroeconomic context, the role of policy support once again takes centre stage. Encouragingly, both fiscal and monetary policies have proactively stepped in, poised to take appropriate actions to cushion the Indian economy from adverse global shocks. It is against this backdrop that the Finance Minister presented her eight Union Budget on February 1.

Balancing growth drivers

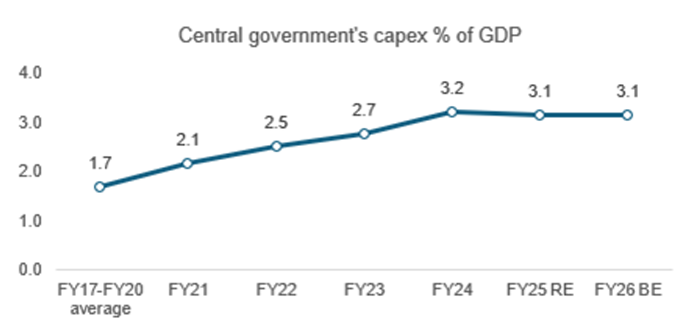

Union Budgets after the Covid-19 pandemic have seen significant capital expenditure (capex) thrust by the government, which has yielded healthy economic growth rates. As the economy normalised, so did some of that support, making way for the private sector to step in. The budget for next fiscal is in the same vein, but interestingly, there is a slight shift in strategy. While government support to growth remains substantial, the tools employed have changed. Capex as a share of gross domestic product (GDP) has been maintained at last fiscal’s levels, and the government has sought to support growth through a consumption lift.

Capex thrust to growth remains

Capex for next fiscal is budgeted at Rs 11.2 lakh crore, up 10% from Rs 10.2 lakh crore this fiscal. This maintains the government’s capex support at 3.1% of GDP. Additionally, there is a nudge to public sector undertakings to expand their capex at a faster pace.

Capex maintained at last year’s rate

Note” RE is revised estimate, BE is budget estimate

Source: Budget documents, Crisil

The Ministry of Road Transport and Highways has again received the highest capex allocation in the budget, though there is a slowdown. Other significant allocations have been made to the Ministry of Railways, the Ministry of Finance (as it disburses long-term interest-free loans to states), the Ministry of Defence and the Ministry of Communications. Together, the five ministries account for a commanding 87.3% of the total budgetary capex.

Investments that had propelled growth last fiscal have slowed significantly this fiscal as government capex growth has decelerated and private investments continue to be sluggish. Any substantial pick-up in investment growth will hinge on accelerating private capex. Exports face headwinds from tariff hikes initiated by the US. Considering global shocks, the budget has sought to reduce customs duty on some key imported inputs. Since India is largely reliant on imports to meet its critical mineral needs, lower duties can help reduce raw material costs and improve competitiveness of domestic manufacturing.

Wielding a consumption push to growth

The key push to consumption in the budget comes from a reduction in the tax burden for the middle class under the new tax regime. About 72% of income taxpayers have adopted this regime. Middle-class consumption has been subdued this fiscal owing to high interest rates and food inflation. The announcements provide relief by increasing the tax rebate limit to Rs 12 lakh from Rs 7 lakh. The proposed changes to the tax structure are expected to lead to tax savings of ~Rs 80,000 annually for an individual earning Rs 12 lakh.

Tax slabs have also been revised under the new tax regime, leading to reduced burden across income levels up to Rs 24 lakh.

These measures are expected to give a leg-up to household consumption next fiscal, following the increase in disposable incomes.

Some of this increase would be channelled towards household savings, which, in recent years, has softened, and towards repayment of household debt.

In another boost to income and, thereby, consumption, the government has increased allocation to key employment-generating and infrastructure-creating schemes, such as Pradhan Mantri (PM) Awas Yojana (for affordable housing construction) and PM Gram Sadak Yojana (for rural roads construction), as well as maintained allocation to the National Rural Employment Guarantee Scheme.

Softening inflation and lower interest rates would improve purchasing power for discretionary spending next fiscal.

Fiscal prudence maintained

Alongside, and admirably so, the government has stayed on the path of fiscal consolidation. Fiscal deficit is budgeted to decline from 4.8% of GDP this fiscal to 4.4% in the next — below the pre-pandemic level of 4.6% in fiscal 2020. A lower fiscal deficit will reduce the fiscal impulse to the economy. The limited fiscal leeway available is being used to support growth — both investment and consumption. Along with budgetary support, lower interest rates — assuming a normal monsoon and lower crude oil prices are expected to support growth in the short term.

Monetary policy joins in to support growth

On February 7, the Reserve Bank of India’s (RBI’s) Monetary Policy Committee (MPC) cut the policy repo rate by 25 basis points (bps) to 6.25%, prompted by easing inflation and a slowing economy. However, the MPC maintained its neutral stance, which gives it flexibility to remain data-dependent and respond to any global shocks. We expect the MPC to cut rates by another 75-100 bps next fiscal. United States (US) tariff hikes, moderating US Federal Reserve rate cuts and weather-related risks will have a bearing on the rate-cutting cycle. Overall, the consumption outlook is positive for next fiscal, assuming another spell of normal monsoon, healthy farm incomes and government support.

Next fiscal, with government capex push limited, a pick-up in private capex will be critical to raise and sustain investment momentum.

Set to expand 6.5% next fiscal, India will remain the fastest-growing large economy.