31 January 2024

Metrics

Powering Tomorrow: India's Thrust in Renewable Energy - A Deep Dive Infographic

Consultancy powerhouse

Wood Mackenzie

unlocks India's remarkable standing in the Middle East and Africa renewable

sector - examining surging market trends, potential, challenges, and strategic

investment hotspots

India’s

Renewable Energy Landscape

India's renewable energy landscape is characterized by significant growth potential, driven by the country's

commitment to increasing its share of clean and sustainable energy. With ambitious targets and substantial

investment opportunities, India has emerged as a key player in the global renewable energy sector. The landscape

encompasses diverse renewable energy sources, including solar, wind, hydro, and emerging technologies such as

battery storage and green hydrogen. The government's initiatives, policies, and missions aimed at promoting

renewable energy deployment have created a conducive environment for investment and development in the sector.

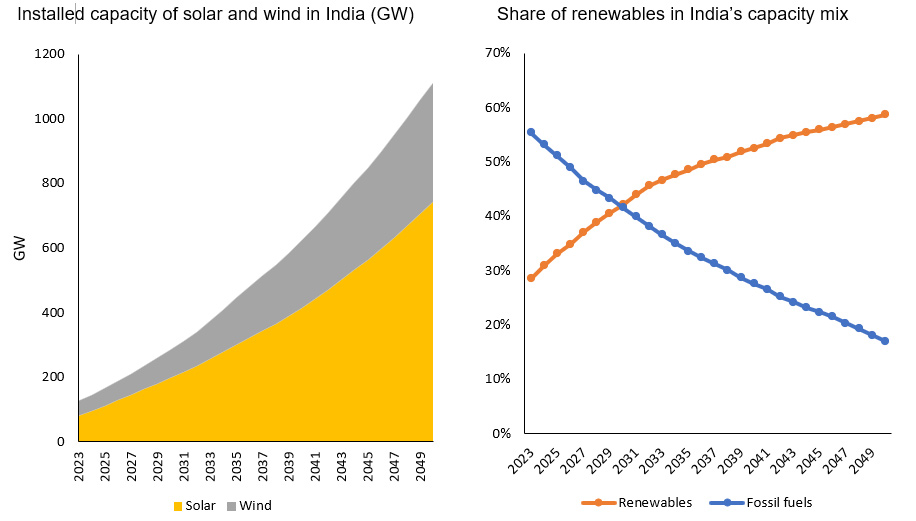

With a total installed capacity of nearly 430 GW in 2023, comprising 28% from wind and solar sources, India is

projected to witness significant expansion, reaching 1,892 GW by 2050 at an average yearly growth rate of 5.6%. The

solar capacity is expected to lead the additions, rising by 9.2% annually on average from 80 GW in 2023 to 741 GW by

2050. Additionally, wind capacity is anticipated to expand from 45 GW in 2023 to around 370 GW by 2050, including

100 GW offshore and 270 GW onshore. The growth in renewables will outpace traditional fossil fuel capacity

additions.

The surge in power demand for charging electric vehicles is expected to contribute over 12% of the total power demand

by 2050. Additionally, power demand for green hydrogen production is projected to reach 381 TWh by 2050,

highlighting a growing avenue for investment and growth.

%

Renewable Potential and Investment Opportunities: Comparative Analysis Across the Middle East and

Africa

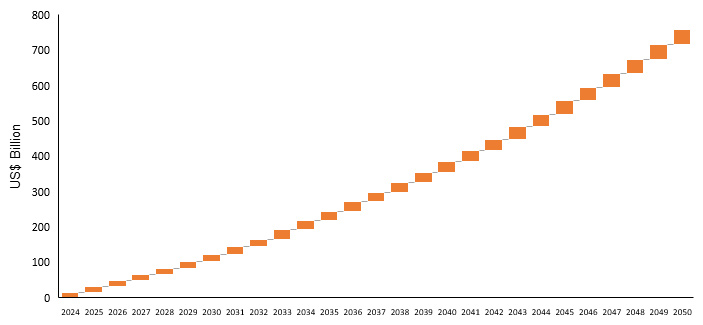

India's renewable energy investment potential from 2023 to 2050 reflects a compelling narrative of growth and

sustainability. Commencing at US$15 billion in 2024, the trajectory demonstrates a robust annual increase, reaching

a staggering USD US$750 billion 2050. This growth is underpinned by dynamic market trends, including significant

capacity additions in solar and wind, technological innovations, and a consistent decline in renewable energy costs,

making such projects increasingly competitive.

Yearly investments in Indian renewable generation sector from 2023 to 2050

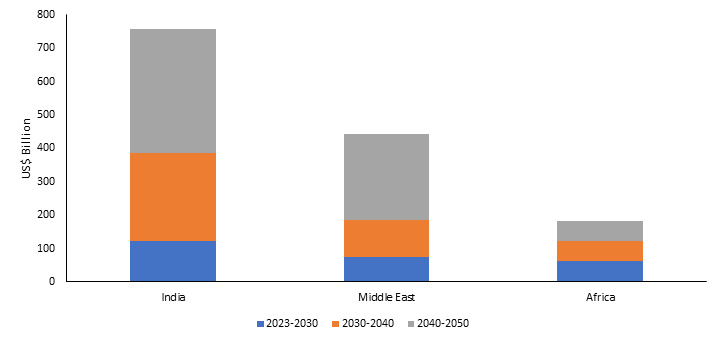

The investment potential in Indian

renewable energy sector, mainly wind and solar, from 2023-2050, is almost 20% higher than that of the Middle East

and Africa combined.

Investment potential in renewable energy technologies – comparing India with the Middle East and

Africa

India's geographical positioning is a strategic asset that plays a pivotal role in its renewable

energy narrative. Nestled in the heart of South Asia, India extends its influence across diverse regions.

India

boasts a diverse range of renewable resources, including solar, wind, and hydroelectric power. The abundance of

sunlight across the country makes solar energy a particularly viable option. The geographical diversity allows for

the harnessing of wind energy in specific regions, ensuring a well-rounded and resilient renewable energy portfolio.

While the Middle East has abundant sunlight, the dependency on hydrocarbons and the economic significance of fossil

fuels present challenges in diversifying the energy mix. Africa, despite rich renewable resources, faces

infrastructure limitations that hinder optimal exploitation.

India's government has set ambitious targets, with a commitment to achieve 500 GW of renewable capacity by 2030.

While the Middle East has set targets, the economic dependency on fossil fuels remains a challenge. Africa, though

emphasizing renewable expansion, grapples with a huge financing gap, impeding innovation and policy

implementation.

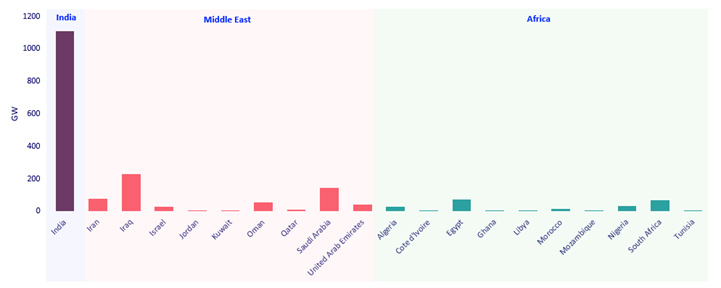

By 2050, the combined wind and solar capacity in India could reach levels of almost 1,100 GW,

far higher than the 250 GW estimated for Africa and 600 GW estimated for the Middle East.

Estimated renewable installed capacity by 2050 – comparing India with the Middle East and Africa

India presents a

massive US$165 billion investment opportunity in solar, wind, and battery storage deployment in just the next

decade. This not only signals a strong market potential but also reflects investor confidence in India's commitment

to renewable energy. While the Middle East emphasizes renewables, the sheer scale of India's investment

opportunities, coupled with its policy support, positions it as a more attractive destination for global investors.

Africa, while emphasizing renewable expansion, needs to address challenges such as energy access and clean cooking

fuels for social and economic development.

Challenges and Roadblocks: Overcoming Coal Dominance, Infrastructure Hurdles, Policy Complexities, and Supply

Chain Gaps

India stands at a crucial juncture in its energy landscape, poised for a transformative shift towards sustainable and

renewable sources. However, this transition is not without its challenges, and the journey to decarbonization is

fraught with obstacles that demand strategic planning and concerted efforts. Some of the major roadblocks and

barriers are:

Persistent Dominance of Coal: Coal remains the

linchpin of India's energy landscape, contributing a staggering 73% to the power generation mix in 2023. Despite

expectations of a decrease to 63% by 2030, it remains the primary energy source. The implications of this reliance

extend beyond just energy generation, influencing environmental sustainability, public health, and climate change.

India's commitment to international climate goals requires a substantial reduction in coal usage. Over-reliance

impedes progress toward meeting emission reduction targets.

Infrastructure and Storage Challenges: India's

total installed capacity is projected to reach 1,892 GW by 2050, highlighting the need for robust infrastructure in

transmission, distribution and storage domains. The role of storage solutions, especially battery technology, is

pivotal in managing the intermittency of renewable sources and ensuring a stable power supply. The rapid growth of

renewable capacity demands substantial investments in storage infrastructure. A lag in funding and implementation

can lead to grid instability and hinder the transition to cleaner energy. Ongoing research and development are

essential for enhancing storage technologies. Advancements in battery efficiency, lifespan, and cost-effectiveness

are critical for widespread adoption.

Policy and Regulatory Hurdles: India's Panchamrit

initiative outlines ambitious goals, including achieving 500 GW of non-fossil fuel electricity by 2030. However,

translating policy objectives into tangible outcomes requires navigating complex regulatory landscapes. The

effectiveness of decarbonization efforts relies on coherent policies that align with long-term goals. Ensuring

consistency in regulations and adapting them to evolving technologies is a perpetual challenge. Encouraging private

sector participation necessitates policies that create a conducive environment for investment. Clear guidelines,

incentives, and regulatory stability are crucial for attracting private capital. India's bureaucratic processes can

be time-consuming and intricate. Streamlining approvals and regulatory procedures is essential for expeditious

implementation of renewable projects.

Manufacturing and Supply Chain Gaps: India faces

challenges in establishing robust domestic supply chains, particularly in the production of components like solar

wafers. The dependence on imports hampers the nation's self-sufficiency in the renewable energy sector. The lack of

a comprehensive domestic supply chain leads to heavy reliance on imported components. This dependence poses risks

related to supply chain disruptions and geopolitical factors. Relying on imports often results in higher costs.

Developing local manufacturing capabilities can contribute to cost reduction and overall competitiveness in the

renewable energy sector. Building a robust supply chain involves technology transfer and knowledge-sharing.

Collaborations with global partners can accelerate the development of indigenous manufacturing capabilities.

Off-Taker Risks: The renewable energy sector in

India faces challenges related to off-taker risks, where the entities responsible for purchasing the generated power

may default on their obligations. This risk is particularly high in long-term power purchase agreements (PPAs) and

can deter potential investors and developers from participating in renewable energy projects. The uncertainty

surrounding off-taker creditworthiness and the potential for payment delays or defaults can significantly impact

project financing and overall project viability.

Low Liquidity in Wholesale Market: The Indian

power exchange market is still in the development stage, and the overall liquidity in the wholesale market is

relatively low. This limited liquidity poses challenges for renewable energy developers and investors, as it

restricts their ability to efficiently transact power and hedge against market risks. The lack of a robust and

liquid wholesale market can hinder the adoption of renewable energy projects, as developers may face difficulties in

securing favorable pricing and off-take arrangements for their generated power.

Procurement Options and Auction Competitiveness:

Procuring power through auctions, which is a common practice in India's renewable energy sector, presents challenges

due to hyper-competitive bidding processes. The intense competition in auctions can lead to aggressive pricing,

potentially impacting the financial viability of renewable energy projects. Moreover, the reliance on auctions for

power purchase agreements introduces uncertainties for developers, as securing favorable PPAs becomes increasingly

challenging in the face of aggressive bidding dynamics.

Market Dynamics and Long-Term PPAs: The

prevailing market dynamics in India's renewable energy sector heavily favor long-term power purchase agreements over

transactions in the wholesale market. Approximately 88% of power is transacted through long-term PPAs, indicating a

reliance on fixed-price arrangements. While long-term PPAs provide revenue certainty, they also limit the exposure

of renewable energy generators to market price fluctuations. This dynamic can pose challenges for developers seeking

to optimize revenue streams and navigate evolving market conditions.

Wrap up

Meeting India’s 2030 targets would necessitate a significant resurgence of rooftop solar and wind

installations, with

renewable investments required to the tune of US$35-40 billion annually. India must install over 40 GW per year of

renewables between 2023 and 2030 to achieve its energy transition targets, which is significantly higher than the

average installation of 12 GW per year seen in the past five years. Despite these challenges, the sector is expected

to expand, offering a massive investment opportunity, signaling a shift towards a more diversified and sustainable

energy mix. India's renewable energy investment story not only holds transformative implications for its own energy

landscape but also resonates globally. As the second-largest power market in Asia Pacific, India contributes

substantially to the global renewable energy market. Its emphasis on innovative technologies positions the nation as

an emerging hub for renewable energy innovations, potentially influencing global trends.